Terrorist Financing Risk

The concept of money laundering is essential to be understood for these working within the financial sector. It is a course of by which soiled cash is transformed into clean cash. The sources of the money in precise are felony and the money is invested in a method that makes it appear like clear money and conceal the identity of the criminal a part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the brand new customers or sustaining present customers the responsibility of adopting ample measures lie on every one who is part of the organization. The identification of such ingredient to start with is simple to deal with instead realizing and encountering such conditions afterward in the transaction stage. The central bank in any nation provides full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such conditions.

The NRA 2015 section 97 recognised that open loop3 prepaid cards had the potential to be high risk. And there is secondary terrorism or terrorist financing threat jurisdictions where crimes occur whose proceeds finance terrorism.

Anti Money Laundering And Counter Terrorism Financing

The overall rating on TF risk is attributable to the combined effect of the findings in respect of the three components of TF risk namely Terrorism Threat Terrorist Financing Threat and Terrorist Financing Vulnerability.

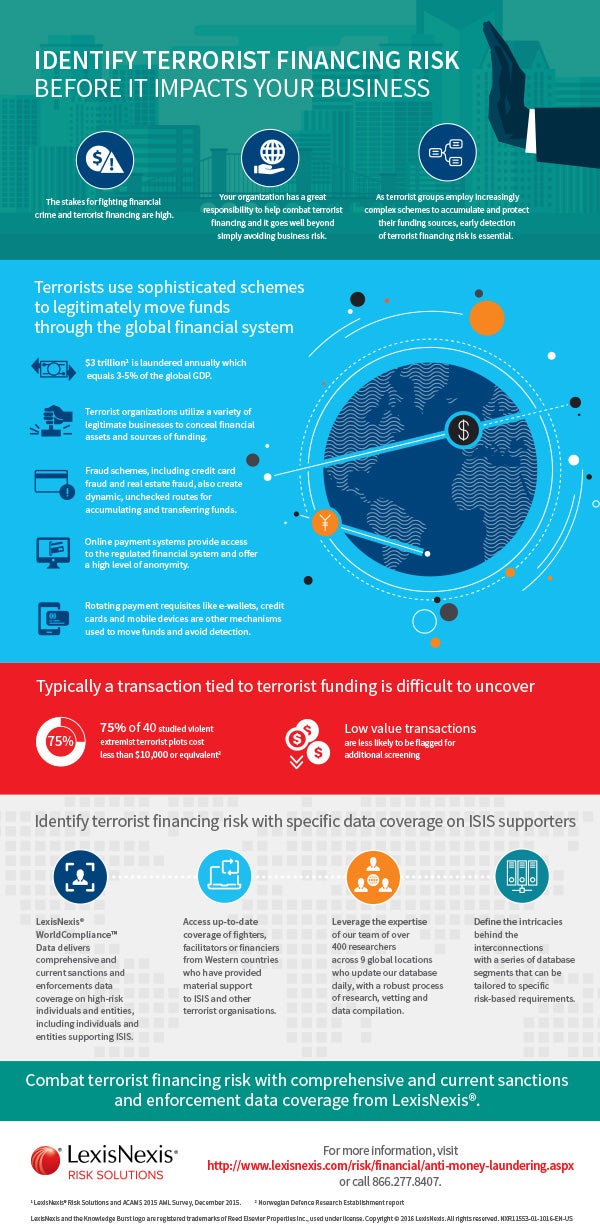

Terrorist financing risk. The FATF developed the indicators in this report to help government agencies and selected private sector entities detect and disrupt the financial flows of terrorists and terrorist organisations. The Looming Risk of Terrorist Financing. Financial institutions expose the US.

While money laundering and terrorist financing is a risk anytime money is exchanged there are industries where the risk is significantly higher. The recent television miniseries The Looming Tower examined how information-sharing failures between law enforcement and intelligence services may have compromised the prevention of. The FATF has decided not to distribute this report publicly to preserve the usefulness of these.

Getting funds to from or for a terrorist organisation recklessly s 10262. Financial system to TF risks that other financial systems may not face. There is active terrorism or terrorist financing threats there are strong geographical or other links to countries that have an active terrorism or terrorist financing threat.

Relevant Risks Indicators. By Jonah Anderson Stuart Willey Partners Jeremy Kuester Counsel and Rebecca Copcutt Associate White Case LLP. 22 Elements of the products offered by EMIs can increase money laundering and terrorist.

National Risk Assessment of Terrorist Financing concludes that the risk of either financial services or non-profit organisations being used to fund terrorism is medium-low. It explores the emerging terrorist financing threats and vulnerabilities posed by foreign terrorist fighters FTFs fundraising through social media. In 2018 the US government updated its National Terrorist Financing Risk Assessment and explained the risk concerning several major international terrorist groups in particular ISIL al-Qaeda in the Arabian Peninsula AQAP and al-Shabaab.

10 Most recently the AsiaPacific Group on Money Laundering APG in cooperation with the Middle East and North Africa Financial Action Task Force MENAFATF. Article 21 of the 1999 Terrorist Financing Convention defines the crime of terrorist financing as the offense committed by any person who by any means directly or indirectly unlawfully and willfully provides or collects funds with the intention that they should be used or in the knowledge that they are to be used in full or in part in order to carry out an act intended to cause death or serious bodily injury. An assessment of the risk of Jersey being used as a conduit for the funding of terrorist activity has been published today Tuesday 20 April.

Relevant component agencies bureaus and offices of Treasury the Department of Justice. Cayman Islands sources are given. The money laundering and terrorist financing risks within the British gambling industry.

A service provider or financial institution has the risk of accepting digital assets or fiat assets that fall within money laundering or terrorist financing offences. National Terrorist Financing Risk Assessment volume and diversity of international financial transactions that in some way pass through US. It also intends to determine the direction of risks based on the emerging and current issues as well as significant developments and progress done domestically and internationally relative to the combating terrorism and its financing.

If you require a copy of a file in an accessible format contact us with details of what you require. The Emerging Terrorist Financing Risks report the result of the call for further research into terrorist financing provides an overview of the various financing mechanisms and financial management practices used by terrorists and terrorist organisations. Some files may be not be accessible for users of assistive technology.

The inherent risk assessment is primarily qualitative in nature. The current offences that relate to the financing of terrorism in the Criminal Code Act 1995 Cth are getting funds to from or for a terrorist organisation intentionally s 10261. Further details on the results of the analysis of these three components are provided in the remainder of this summary.

MLTF risks must be identified analyzed and ultimately contained by service providers or financial institutions. This risk assessment is an update to the Second National Risk Assessment NRA specifically on the understanding and assessment of terrorism and terrorism financing TF risks in the Philippines. These industries include any financial institution like banks currency exchange houses check cashing facilities and payment processing companies.

A terrorist financing risk assessmentis a product or process based on a methodology agreed by the parties involved that attempts to identify analyse and understand terrorist financing risks and serves as a first step in addressing them. In addition to the MLTF risks there is also a reputation risk. Collecting funds for financing terrorism.

Terrorist financing TF risks is an essential part of dismantling and disrupting terrorist networks as well as the effective implementation of the risk-based approach RBA of counter terrorist financing. The 2018 National Terrorist Financing Risk Assessment2018 NTFRA identifies the terrorist financing TF threats vulnerabilities and risks that the United States currently faces updating the 2015 National Terrorist Financing Risk Assessment 2015 NTFRA. Terrorist financing risk as low but this was revised to a medium risk rating by the NRA 2017.

Inherent risk based on an analysis of primary and secondary sources to identify the activities and characteristics of NPOs that are likely to be at risk of terrorist financing abuse.

Countering Terrorism Financing Through Anti Money Laundering Measures Global Risk Insights

Money Laundering Terrorist Financing Risk Assessment

Combatting Money Laundering And Terrorist Financing Government Se

Virtual Currencies Regulation And Terrorist Financing Risks Acams Today

Https Www Ppatk Go Id Backend Assets Uploads 20200221111751 Pdf

Counter Terrorist Financing Lexisnexis Risk Solutions

4 Differences Between Money Laundering And Terrorist Financing

Anti Money Laundering And Counter Terrorism Financing

New Technologies The Emerging Terrorist Financing Risk Acams Today

News Financial Action Task Force Fatf

Anti Money Laundering And Counter Terrorism Financing

Money Laundering Terrorist Financing Risk Assessment

Countering Terrorism Financing Through Anti Money Laundering Measures Global Risk Insights

Documents Financial Action Task Force Fatf

The world of rules can look like a bowl of alphabet soup at times. US money laundering laws are no exception. We have now compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm targeted on protecting monetary services by decreasing danger, fraud and losses. We now have massive bank expertise in operational and regulatory danger. We've got a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many hostile penalties to the group as a result of dangers it presents. It increases the likelihood of major risks and the chance price of the financial institution and in the end causes the bank to face losses.

Komentar

Posting Komentar